Discover Nearby Protection: Medicare Supplement Plans Near Me

Discover Nearby Protection: Medicare Supplement Plans Near Me

Blog Article

Discover the Ideal Medicare Supplement Program for Your Insurance Coverage Needs

In the world of healthcare insurance coverage, the mission for the optimal Medicare supplement plan customized to one's details requirements can often appear like browsing a labyrinth of choices and factors to consider (Medicare Supplement plans near me). With the complexity of the health care system and the range of readily available strategies, it is essential to approach the decision-making procedure with an extensive understanding and strategic way of thinking. As individuals get started on this trip to secure the very best coverage for their insurance policy requires, there are vital elements to ponder, comparisons to be made, and professional tips to reveal - all vital elements in the mission for the ideal Medicare supplement strategy

Recognizing Medicare Supplement Plans

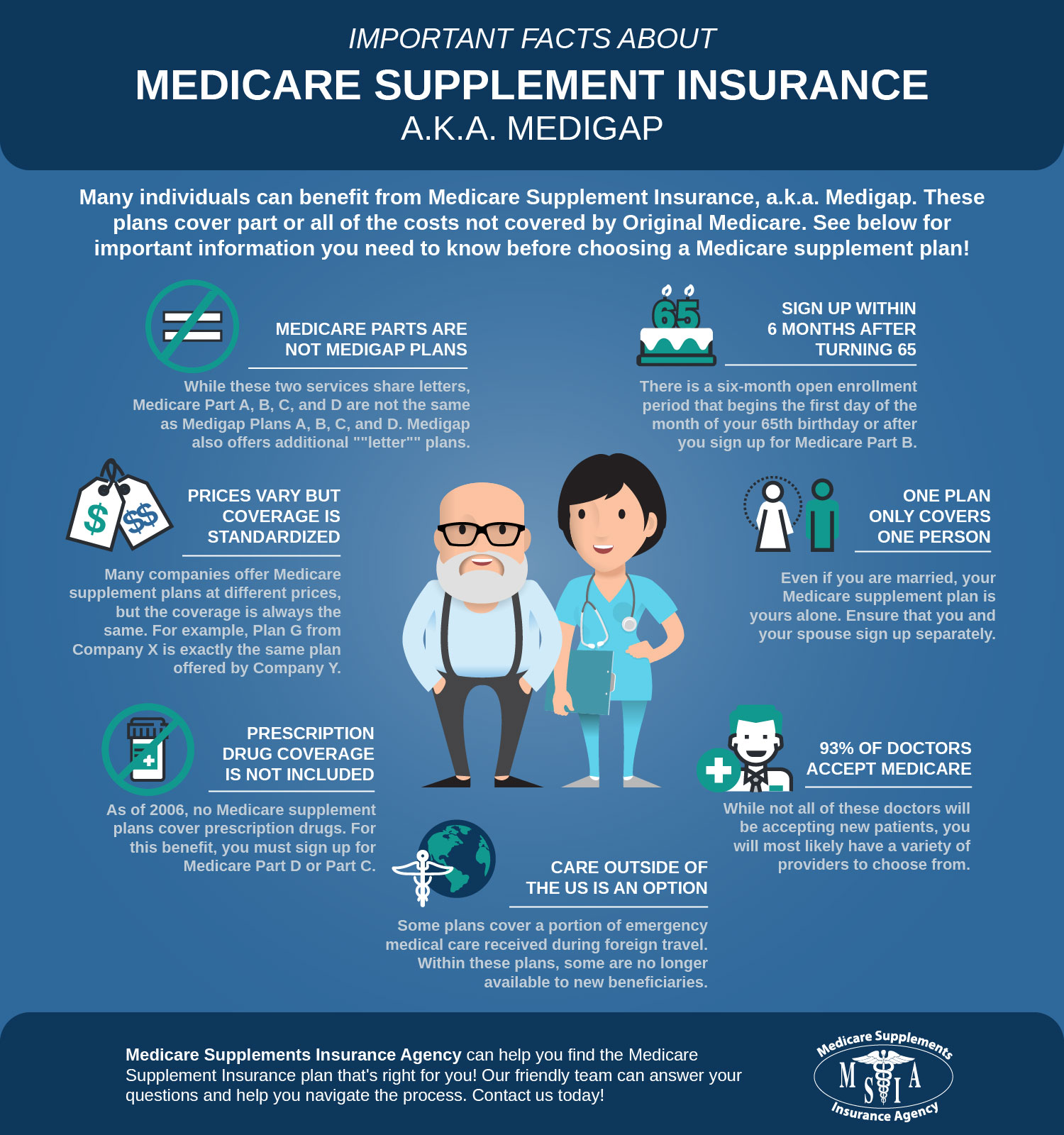

Comprehending Medicare Supplement Plans is necessary for individuals seeking added coverage beyond what initial Medicare offers. These plans, likewise known as Medigap policies, are provided by exclusive insurance policy business to aid pay for medical care prices that initial Medicare does not cover, such as copayments, coinsurance, and deductibles. It's essential to keep in mind that Medicare Supplement Program can just be acquired if you already have Medicare Part A and Part B.

One trick element of understanding these plans is recognizing that there are different standard Medigap plans readily available in most states, classified A via N, each using a various collection of basic advantages. Plan F is one of the most extensive plans, covering virtually all out-of-pocket costs that Medicare doesn't pay. On the other hand, Plan A provides fewer advantages however might include a reduced premium.

To make an informed decision regarding which Medicare Supplement Plan is best for you, it is necessary to consider your medical care requires, budget plan, and protection preferences. Consulting with a licensed insurance policy agent or checking out online sources can assist you navigate the complexities of Medicare Supplement Program and choose the finest alternative for your individual conditions.

Elements to Take Into Consideration When Selecting

Having a clear understanding of your healthcare requirements and monetary capacities is critical when considering which Medicare Supplement Plan to choose. Think about variables such as prescription drug coverage, physician brows through, and any kind of possible surgeries or treatments.

An additional important factor to consider is the plan's insurance coverage choices. Various Medicare Supplement Plans offer varying levels of protection, so make sure the plan you select lines up with your specific medical care requirements. Additionally, think about the online reputation and economic stability of the insurance policy firm providing the strategy. You want to select a service provider that has a strong record of client complete satisfaction and timely cases handling.

Contrasting Different Plan Options

When examining Medicare Supplement Program, it is necessary to compare the different strategy alternatives offered to determine the most effective suitable for your health care demands and financial situation. To start, it is essential to recognize that Medicare Supplement Plans are standard throughout many states, with each plan labeled by a letter (A-N) and providing various degrees of protection. By contrasting these strategies, people can examine the why not look here insurance coverage offered by each plan and choose the one that best satisfies their details requirements.

When comparing various strategy choices, it is necessary to take into consideration aspects such as month-to-month costs, out-of-pocket costs, coverage advantages, copyright networks, and customer fulfillment ratings. Some strategies may use more thorough coverage however come with greater regular monthly premiums, while others may have reduced costs but fewer advantages. By examining these aspects and considering them versus your medical care demands and budget plan, you can make an informed choice on which Medicare Supplement Plan provides the many worth for your individual situations.

Tips for Discovering the Right Insurance Coverage

Next, study the readily available Medicare Supplement Strategies in your area. Understand the coverage supplied by each plan, including deductibles, copayments, and coinsurance. Compare the advantages provided by various strategies to determine which straightens finest with your healthcare top priorities.

Look for suggestions from insurance policy representatives or brokers specializing in Medicare plans - Medicare Supplement plans near me. These specialists can give important understandings into the subtleties of each plan and aid you in selecting the most suitable coverage based upon your private circumstances

Lastly, evaluation client responses and rankings for Medicare Supplement Plans to evaluate general satisfaction levels and recognize any recurring issues or issues. Using these tips will certainly assist you browse the complex landscape of Medicare Supplement Plans and find the protection that finest fits your needs.

How to Enlist in a Medicare Supplement Plan

Enrolling in a Medicare Supplement Plan entails an uncomplicated procedure that calls for careful consideration and documentation. The first step is to guarantee qualification by being signed up in Medicare Component A and Part B. As soon as eligibility is validated, the next action is to study and contrast the available Medicare Supplement Program to find the one that best fits your medical care requirements and budget plan.

To register in a Medicare Supplement Plan, you can do so during the read the article Medigap Open Registration Duration, which begins the very first month you're 65 or older and enrolled in Medicare Component B. During this period, you have ensured problem legal rights, meaning that insurance coverage firms can not refute you insurance coverage or charge you higher costs based upon pre-existing problems.

To register, merely speak to the insurance provider using the preferred strategy and complete the needed documentation. It's essential to review all terms prior to registering to ensure you recognize the coverage provided. As soon as registered, you can delight in the included benefits and satisfaction that come with having a Medicare Supplement Plan.

Verdict

Finally, selecting the most effective Medicare supplement strategy calls for cautious factor to consider of elements such as protection choices, expenses, and service provider networks. By comparing different strategy options and assessing specific insurance policy requirements, individuals can find the most ideal protection for their medical care needs. It is essential to enroll in a Medicare supplement plan that supplies extensive advantages and financial security to make sure peace of mind in managing health care expenses.

Report this page